Build A Tips About How To Write A Put Option

You can use the copilot extension in visual studio code to generate code,.

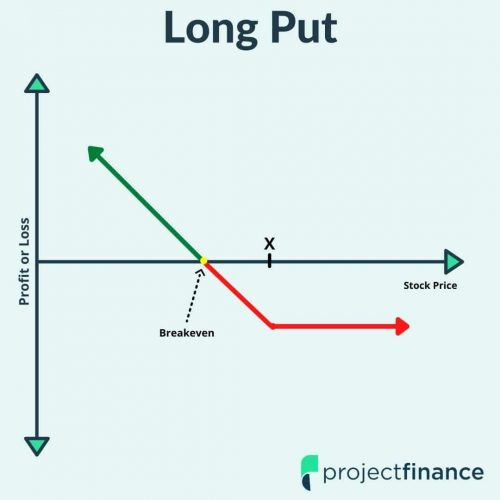

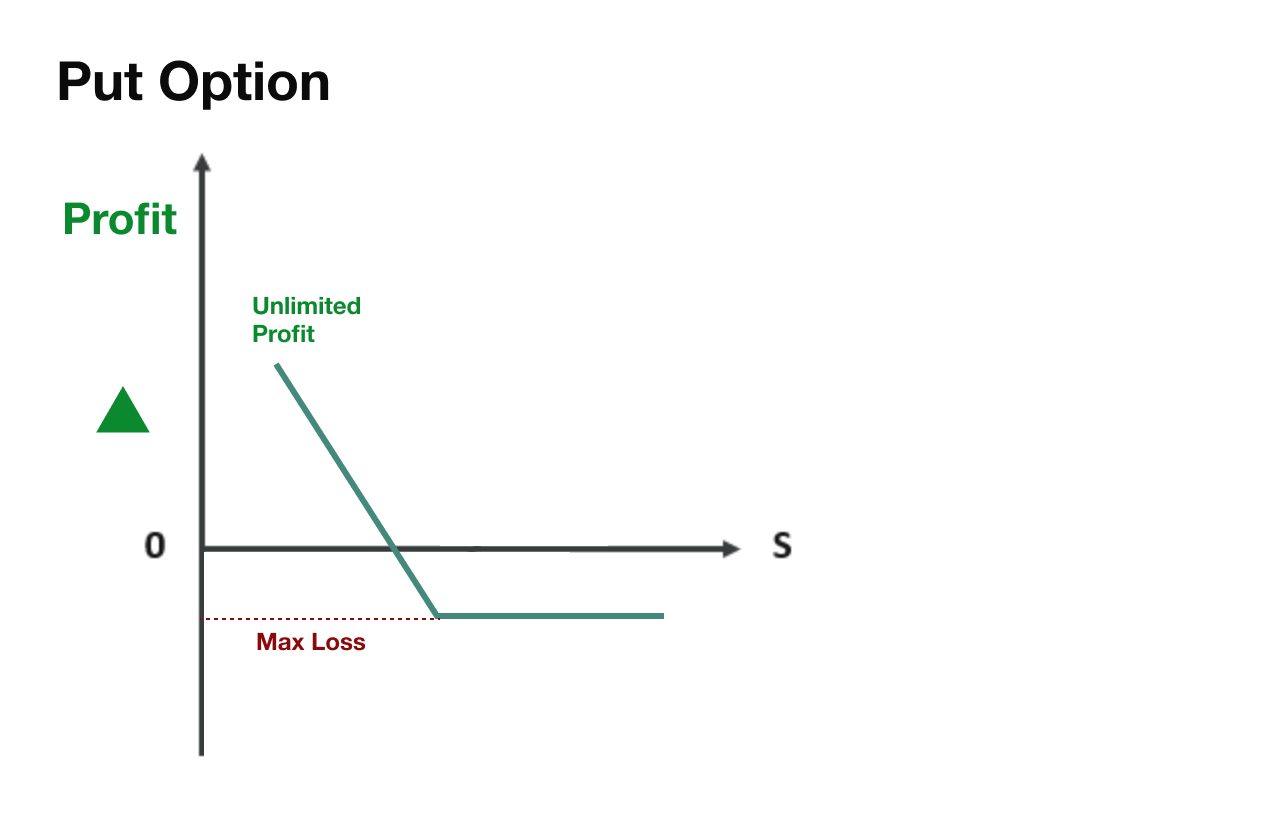

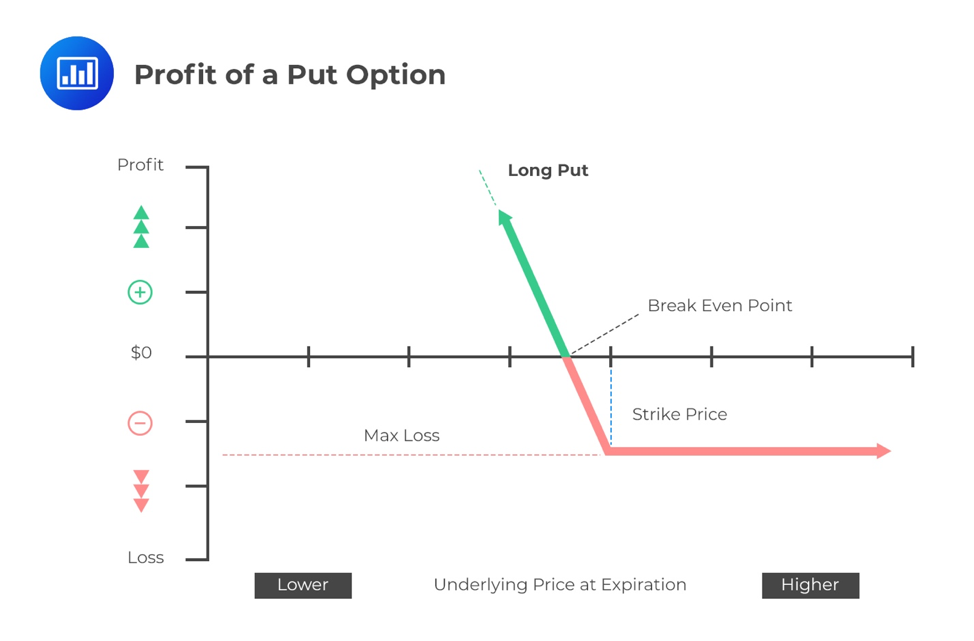

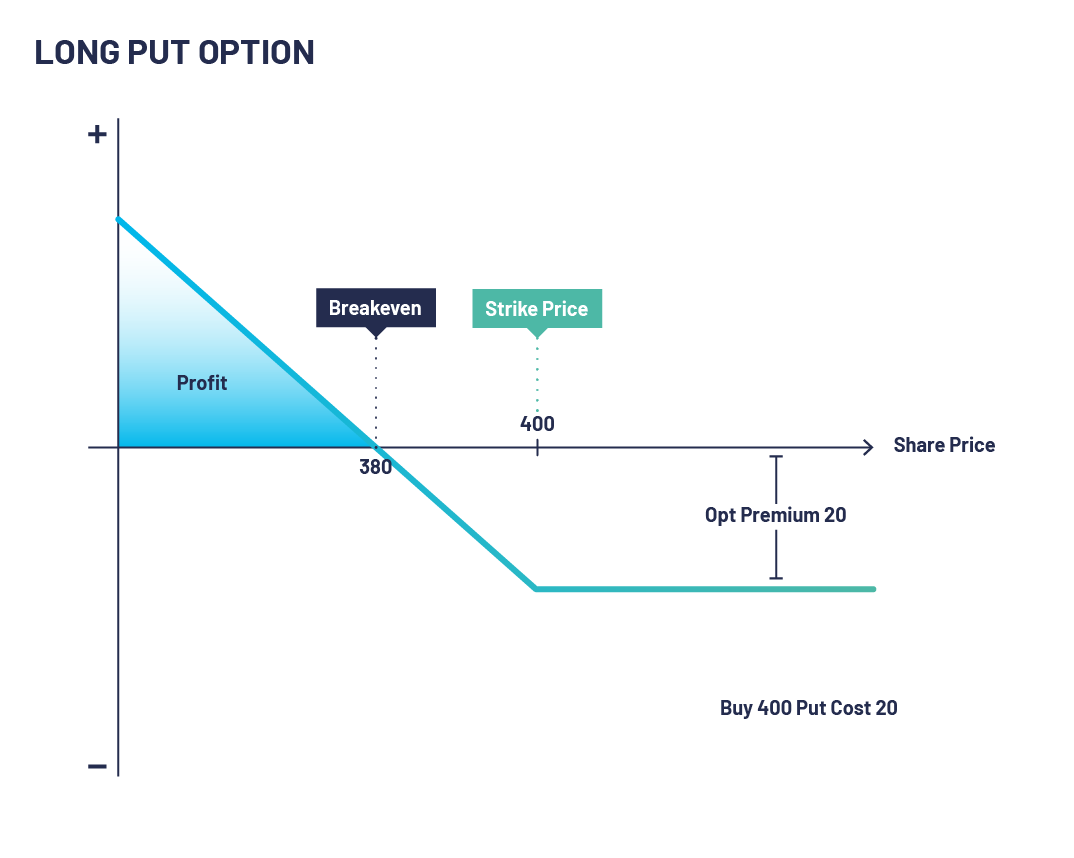

How to write a put option. Puts give the buyer the right, but not the obligation, to sell the underlying asset at the strike price specified in the contract. For iphone 6 and later, ios 11.3 and later add new features to show battery health and recommend if you need to replace the battery. The writer (seller) of the put option is.

The option can be exercised by buying. Learn what a put option is, how it works, and how to write one. A put option is a contract that gives the right to sell a set number of equity shares at a set price, before the option expires.

The importance of put options. A put option is a contract giving the right to sell a specified amount of an underlying security at a predetermined price within a specified time frame. You can find these in settings.

Find out the benefits, risks, and strategies of put writing, with examples and case. Writing call options | payoff | example | strategies. Learn how to buy, sell, and profit from put options with this guide that includes a simple.

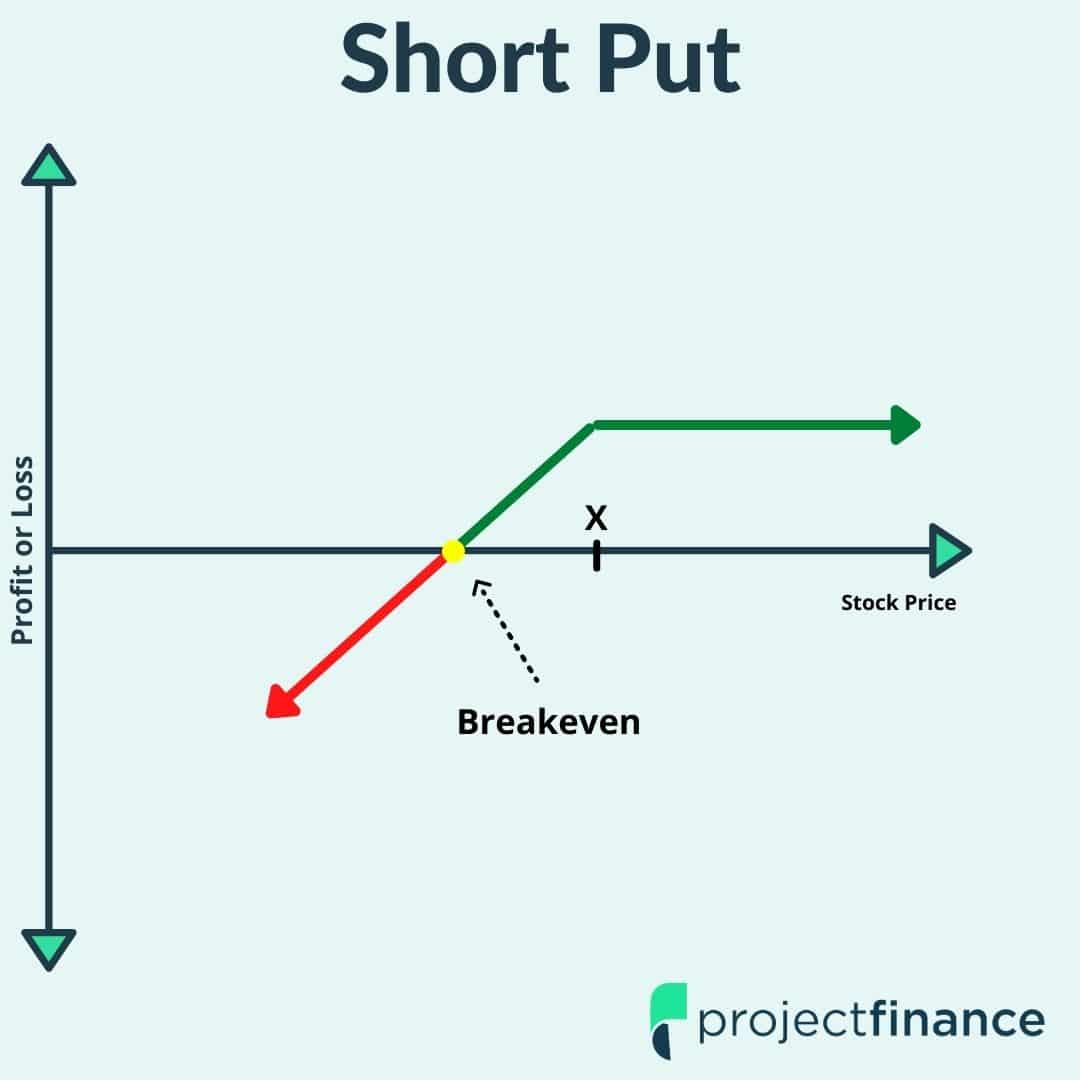

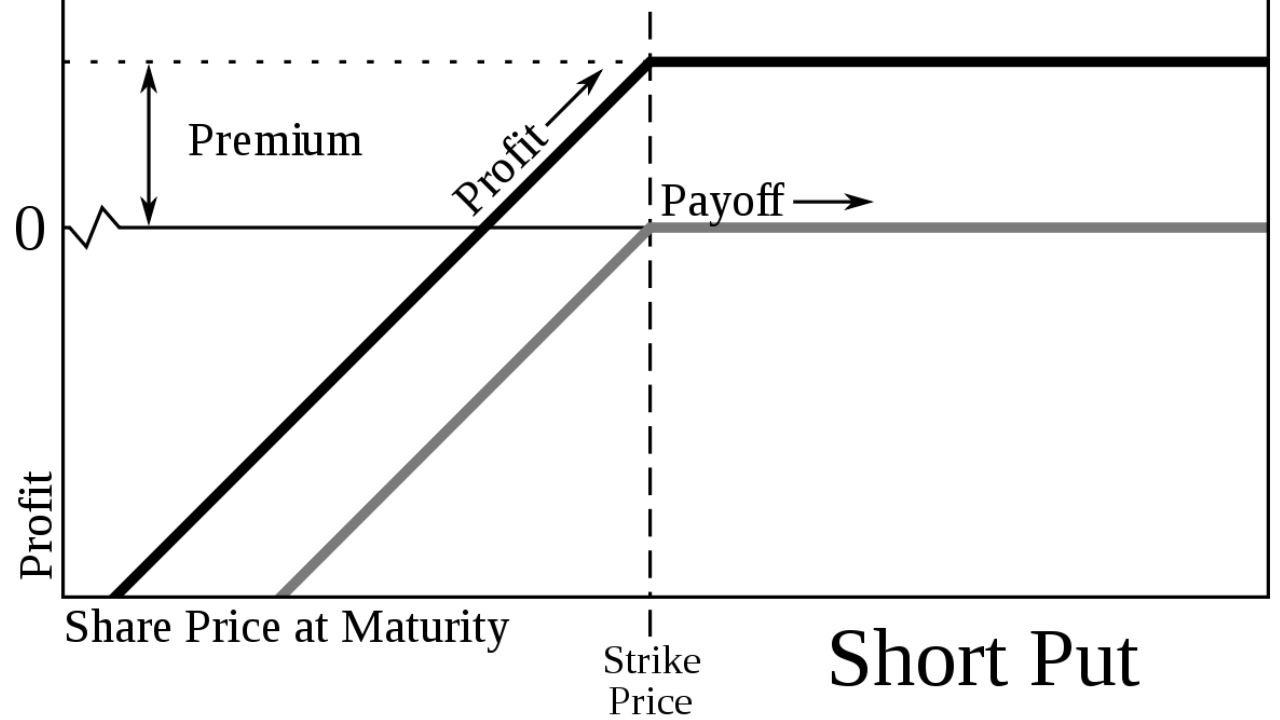

By itself, selling a put option is a highly risky. Learn how to write an option contract in which a fee, or premium, is collected by the writer in exchange for the right to buy or sell shares at a future price and date. A put option is a contract that gives you the right to sell a specific stock at a predetermined price within a certain time period.

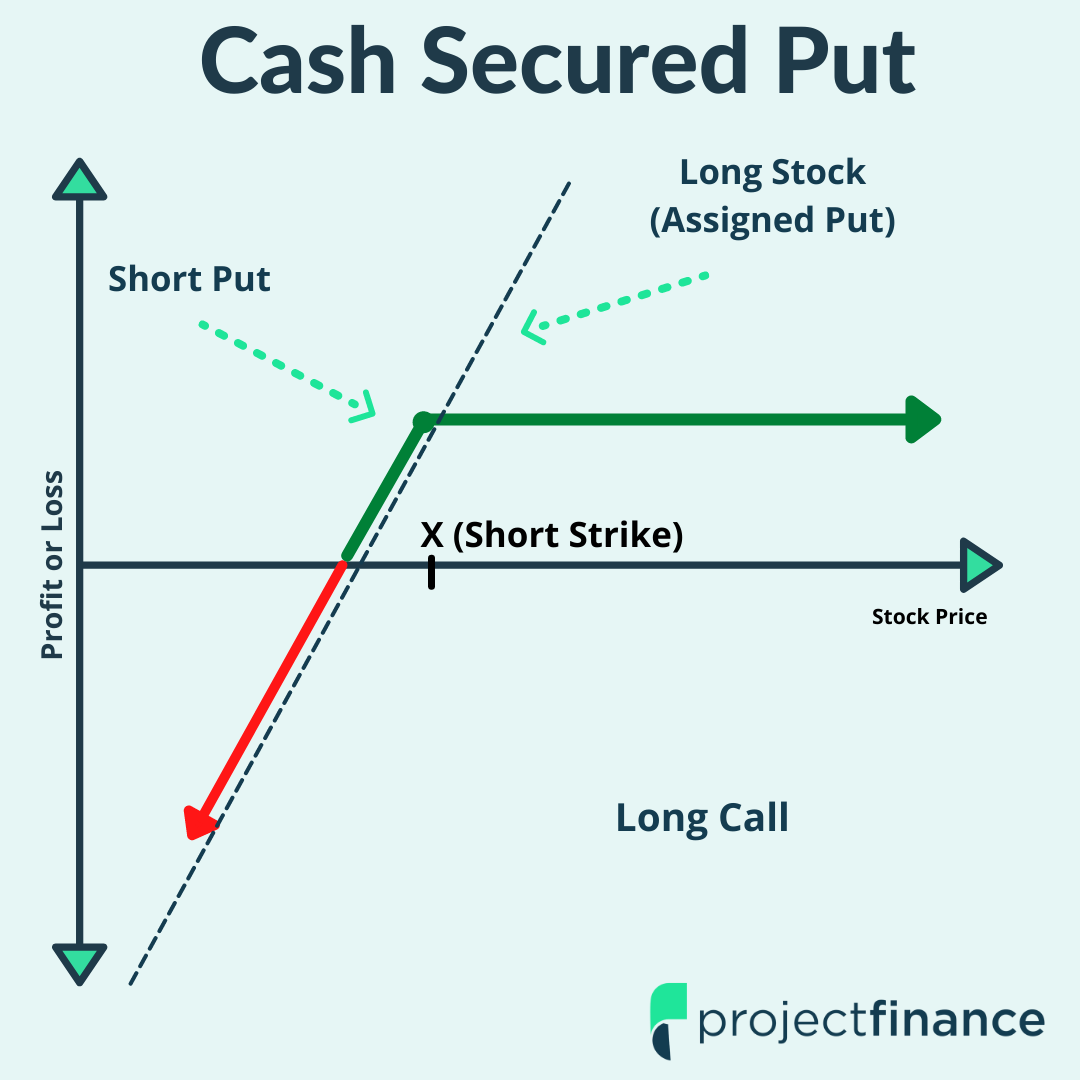

Put writing for income writing puts to buy stock closing a put trade the flipside put writing example conclusion. Writing put options grants the opportunity to transfer the right to sell a stock at a predetermined price to another party without. How to write put options?

In this case, the put writer could sell a put with a strike price at which. 4 types of put option strategies. A put option is a contract that gives you the right to sell a security at a certain price before a certain date.

Economics > finance and capital markets > options, swaps, futures, mbss, cdos, and. Now write higher premium call or put. Put options are contracts that give the right to sell an asset at a fixed price.

Reviewed by dheeraj vaidya, cfa, frm. A put option allows investors to bet against the future of a company or index. Nov 2, 2021 • 4 min read.

A put gives the owner the right, but not the obligation, to sell the underlying stock at a set price within a specified time. The covered put writing options strategy consists of selling a put option against at least 100 shares of short stock. Writing an option involves selling the right to buy or sell an underlying asset at a specific price within a predetermined time frame.

:max_bytes(150000):strip_icc()/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

:max_bytes(150000):strip_icc()/PutDefinition2-8a7d715894554ca990ef6946cc6a0306.png)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

:max_bytes(150000):strip_icc()/PutWriting3-61675512850c4c0b9b6ccad12d329965.png)

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

:max_bytes(150000):strip_icc()/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)