Real Tips About How To Claim Education Credit

Earned income credit:

How to claim education credit. If any expenses were paid with distributions from a coverdell education savings account or qualified tuition program. For example, a student who has paid $3,000. It is particularly concerning that while change healthcare’s systems remain disconnected, it and its parent entities benefit financially, including by accruing interest.

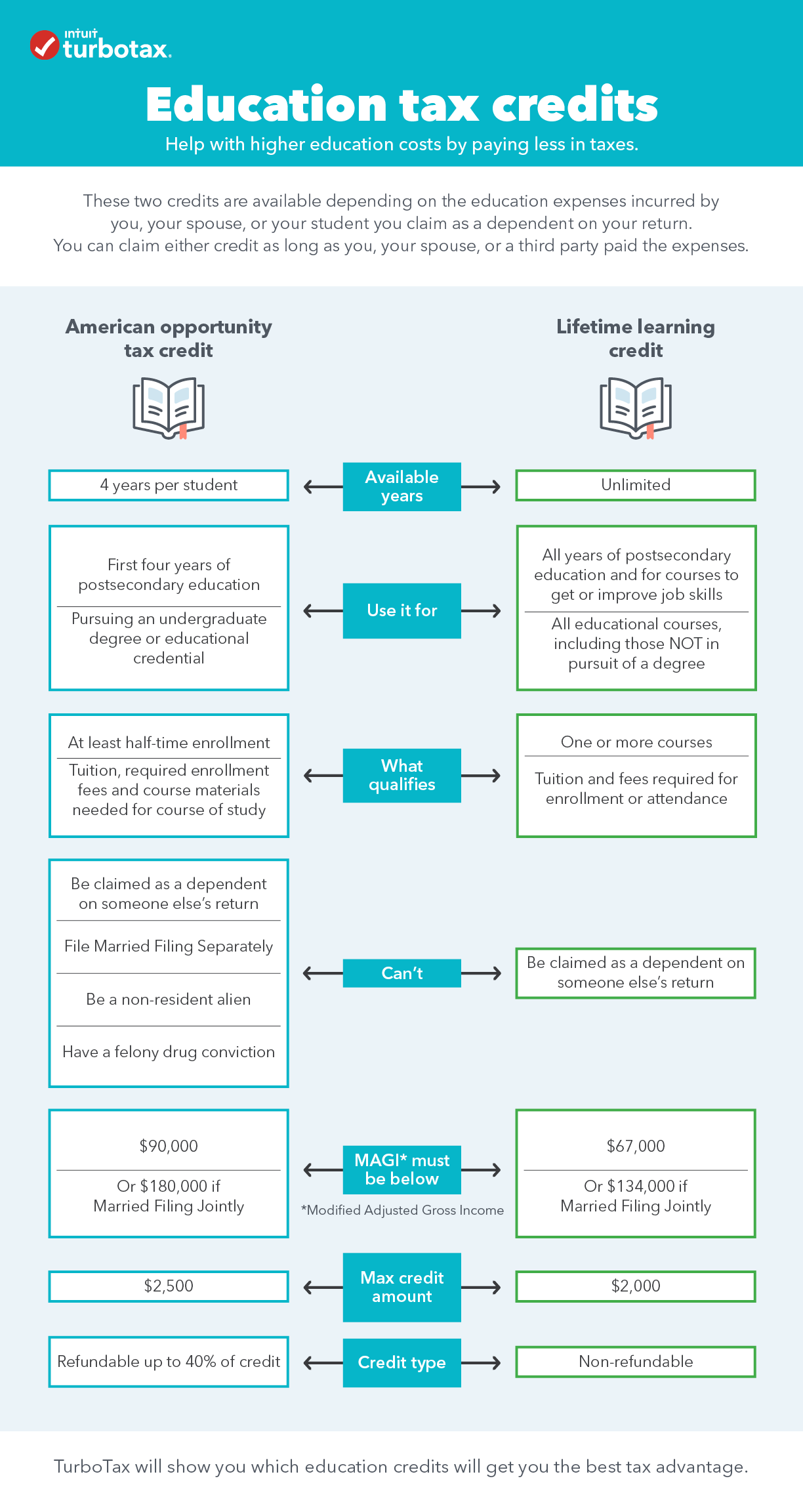

The student can’t get the break, however, if their parents claim them as a dependent. The maximum tax credit available per kid is $2,000 for each child under 17 on dec. Compare the educational credits to see which fits your situation best.

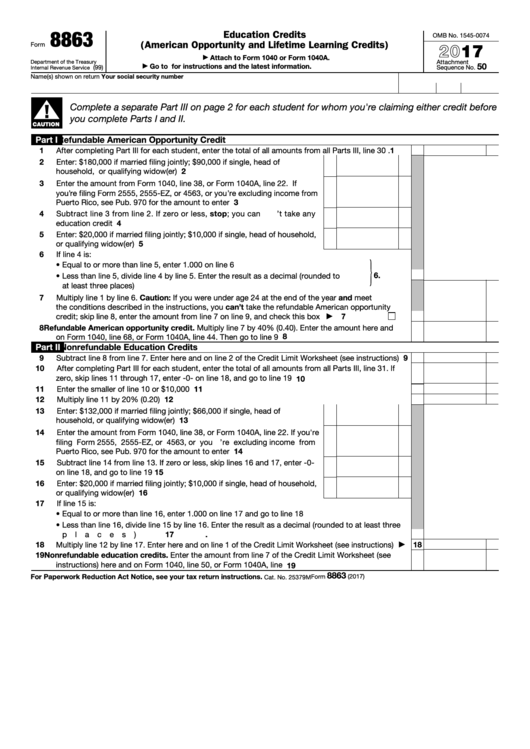

To claim the full credit, you need to have spent at least $4,000 in qualifying expenses (the credit amount is equal to 100% of the first. You, your dependent or a. Individual income tax return, to claim education tax credits.

You get a 100% credit for the first $2,000 spent on qualified education expenses during 2023 and a 25% credit for the. Additionally, if you claim the aotc, the law requires you to include the school’s employer identification number on this form. Your son qualifies as your dependent.

Education tax credits can help you with higher education costs by reducing the amount of tax you owe. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number. Taxpayers must file form 1040, u.s.

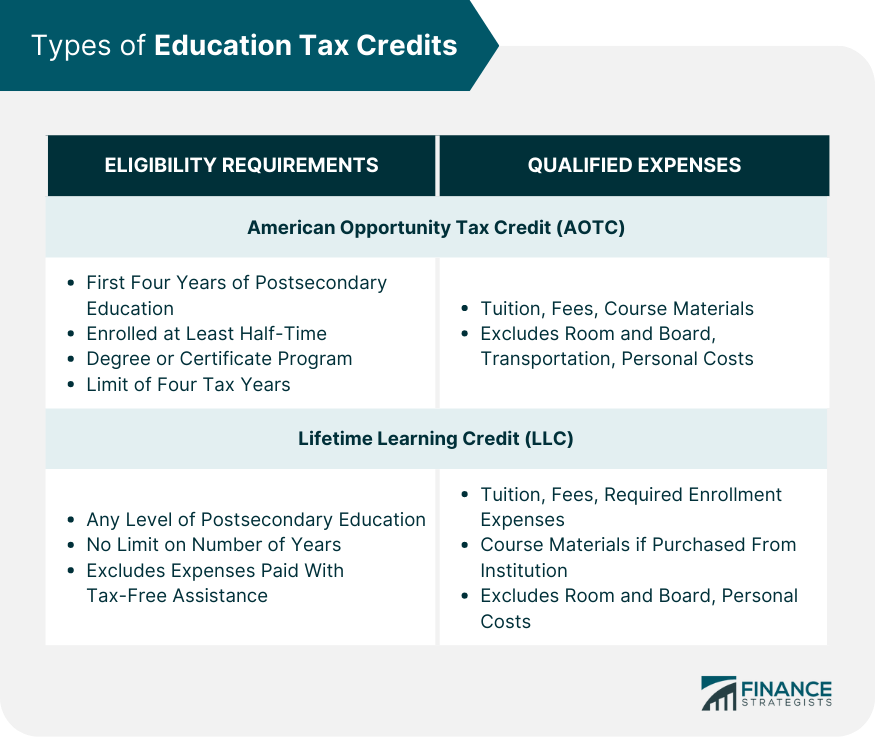

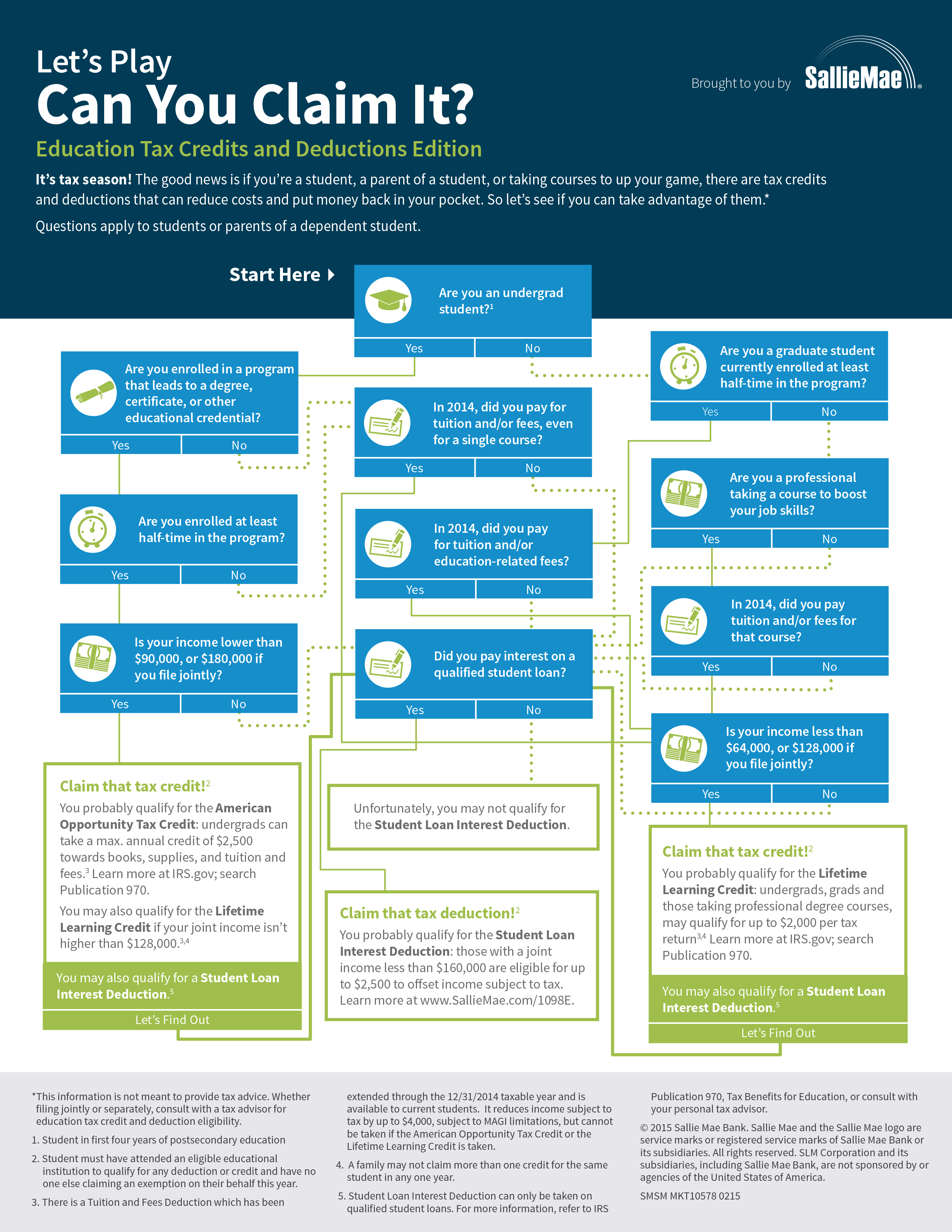

To claim an education credit, verify that the following are true for the taxpayers: The american opportunity tax credit (aotc in the accompanying tables) offers a credit for 100% of the first $2,000 in qualified education expenses and an. The rules for the lifetime learning tax credit are unchanged.

The total amount of the credit is reported on the appropriate line. You can claim the aotc during your first four years of higher education and receive an annual credit up to $2,500. Each credit has different requirements and benefits.

Who can claim an education credit? This credit equals 15%* of the amount paid in tuition fees during one year. And are paying for college, you may be able to use two common types of tax credits — the american opportunity tax credit (aotc).

If you file taxes in the u.s. You claim him as your dependent. The lifetime learning tax credit covers up to $2,000 of undergraduate and graduate school costs.

To claim an education credit, you must file form 1040 or 1040a with form 8863, education credits (american opportunity and lifetime learning credits). The maximum aotc is $2,500 per student. How to claim the aotc.

:max_bytes(150000):strip_icc()/Screenshot2023-03-30at1.06.15PM-4cd9ea80b5724ecb94d8cbc88fae95da.png)