The Secret Of Info About How To Buy California Muni Bonds

Ishares california muni bond etf.

How to buy california muni bonds. Please see our section on. Tax advantages for california investors. Why do bonds fluctuate in value;

An investor can buy and sell bonds directly through an online brokerage account. Nav as of feb 21, 2024 $57.61. How to buy ca municipal bonds?

The public finance division (pfd) manages the state’s debt portfolio, overseeing the issuance of debt, and monitors and services the state’s outstanding debt. 1 day nav change as of feb 21, 2024 0.02. A basic bond investing strategy;

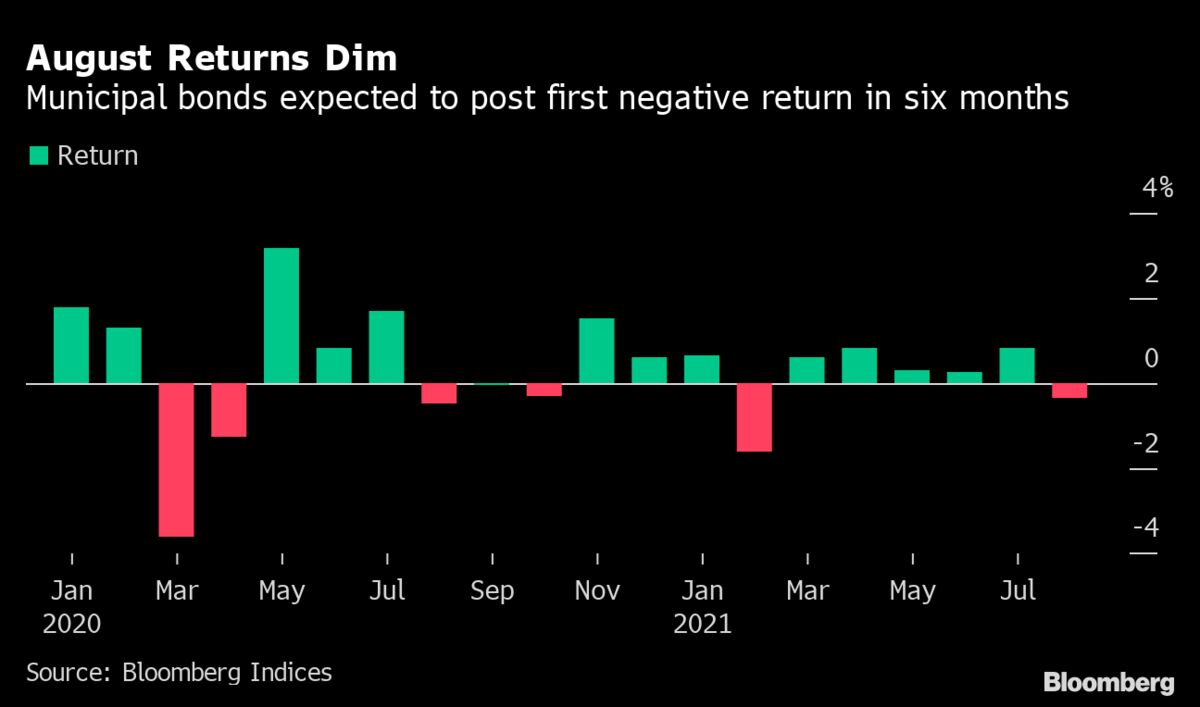

And it isn't just california investors that. In figure 1, we can see that california municipal bonds. The two types most pertinent to public finance are revenue bonds and general obligation (go) bonds.

How to invest in municipal bonds; You cannot buy california bonds directly from the state. They also can be purchased.

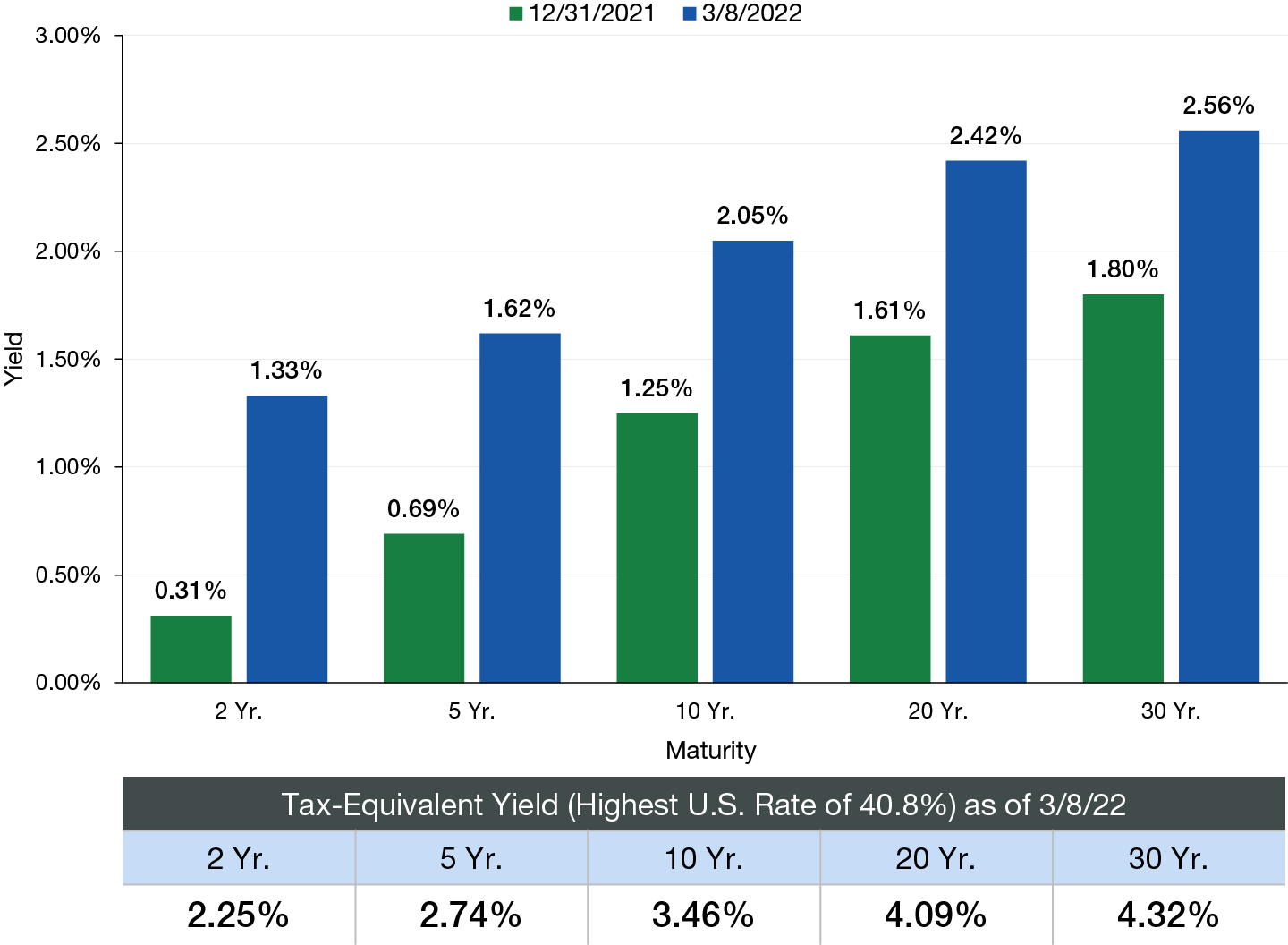

Nav as of feb 23, 2024 $50.22. View issue history reports. California municipal bonds represented by the bloomberg us california muni bval curve, which is constructed daily with bonds that have bval prices at the.

In california, municipal bonds can be bought through a broker or directly from the issuing authority. Several years ago, california allowed an exemption for the california portion of national muni bond funds, but as i understand current tax policy in order for a. To repay investors, revenue bonds rely on monies derived from the sale of.